Texcell, a French provider of biosafety contract services, recently acquired German company Vivo Science GmbH, a GLP/GMP compliant contract research test facility specialising in toxicology, immunology & virology in vivo studies. The acquisition is part of Texcell’s aim of expanding its portfolio of services in the areas of pre-clinical & clinical research, with the ultimate strategic aim of becoming a key immunology & immunotoxicity player in Europe.

Texcell, a French provider of biosafety contract services, recently acquired German company Vivo Science GmbH, a GLP/GMP compliant contract research test facility specialising in toxicology, immunology & virology in vivo studies. The acquisition is part of Texcell’s aim of expanding its portfolio of services in the areas of pre-clinical & clinical research, with the ultimate strategic aim of becoming a key immunology & immunotoxicity player in Europe.

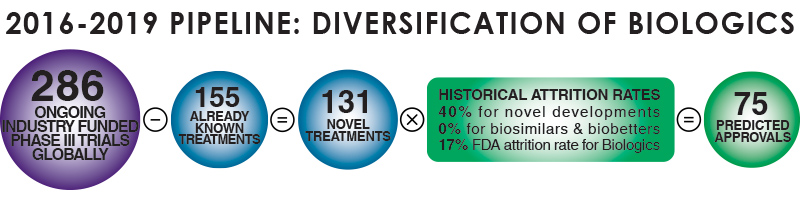

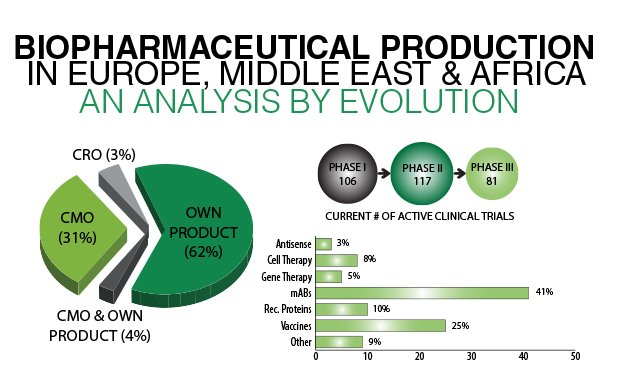

The rapid growth of the global Biopharma market has resulted in increased investment in Biologics, which have been gaining share in pipelines and are now approaching a 1:1 ratio with the development of small molecule therapies, according to proprietary research by Evolution Global. Our analysis of clinical trial growth in Biologics in EMEA over the last 5 years suggest that the trial domain is growing by 11% per annum (CAGR), with the manufacture of recombinant proteins, vaccines & monoclonal antibodies the predominant biologics categories. Currently recombinant proteins are the largest category; however the clinical trial landscape in EMEA suggests that monoclonal antibodies will soon overtake recombinant proteins as the predominant category of biologics.

As a direct result of the proliferation of Biologics, there is an increased demand for outsourcing services such as biosafety testing, viral clearance and QC testing services. Endogenous or adventitious viral agents are generally regarded as product impurities that are not acceptable in the final drug dosage. Viral safety is a vital quality attribute of a drug product, and ensuring freedom from adventitious or endogenous viral agents is therefore crucial for the safety of biological drug recipients. Currently these services are provided by a limited number of players, including Charles River, SGS, Eurofins & MilliporeSigma.

Geographic analysis by Evolution Global reveals that Europe commanded the largest share of the global Biosafety testing market in 2015. Our Biopharmaceutical Manufacturing data visualisation highlights 55 biomanufacturing sites across Germany, including Boehringer’s Biberach site, which claims to have Europe’s largest facilities dedicated to biopharmaceutical development and manufacturing. Comparatively France contains 22 sites with a focus on Biomanufacturing. Of these facilities, Sanofi’s investment of nearly €200M has resulted in the development of its first cell culture biotechnology platform to produce monoclonal antibodies.

In acquiring Vivo Science, Texcell is going forward with its policy of internalising virology & Immunology services whilst reinforcing its presence in both Germany and France. “Texcell’s acquisition of Vivo Science raises questions on whether any competitive advantage can be leveraged by less dominant players offering a local presence in the major Biopharma hubs,” notes Evolution Global’s Managing Director Dr. Jason Beckwith. “It will be of interest to monitor the ongoing impact of localised Biosafety testing services on the European Biopharma contract services industry going forward. Whilst smaller contract services players such as Texcell have the disruptive potential to encourage further M&A activity within the industry, the logistical advantages offered by local players must be weighed-up against the benefits of utilising established major players with proven track records and established brand names.”

To view Texcell’s full press release regarding the Vivo Science acquisition, please click here.

Follow Evolution Global on Twitter, Facebook and LinkedIN to keep up-to-date with news and trends from the biotechnology, biosciences, medical device, IT and Intellectual Property industries.