The field of CAR-T immunotherapy presents a tantalising idea: reengineering a patient’s immune cells to attack cancer. CAR-T immunotherapy has the potential to revolutionise the way we treat cancer, and as such the industry has rushed to develop, test and approve novel treatments, resulting in a CAR-T race to commercialisation. Recent developments, however, have severely dampened the hype surrounding Autologous CAR-T immunotherapies, shaking a once burgeoning industry that attracted significant investment through private placements, VC funding and IPO listings.

The trouble began in July, when Seattle-based Juno Therapeutics announced the death of three patients involved in their Phase II clinical trial of their lead CAR-T candidate JCAR015. Juno halted the trials and pointed to fludarabine, a preconditioning agent used in the treatment process, as the culprit that created a toxic combination with JCAR015, ultimately causing fatal cerebral edemas. After only five days on hold, the FDA gave Juno permission to resume the clinical trials.

In areas with this type of risk, Big Pharma has historically adopted a watch-and-wait strategy; whilst all are aware of the concept, they remain hesitant to engage due the entry costs to getting involved. However, Novartis bucked the Big Pharma trend in 2012, when they formed an alliance with the University of Pennsylvania to expand the use of personalised T-Cell Therapies for cancer patients. However, by the end of August 2016, Novartis shuttered its cell and gene therapy unit, laying off 120 employees in the process.

Autologous CAR-T immunotherapy was dealt another blow just last week, when Juno Therapeutics announced a further two deaths in their JCAR015 trial, attracting significant negative attention not only to the viability of CAR-T immunotherapy, but also to the FDA’s seemingly rushed decision to resume the trial following the initial patient deaths just four months earlier.

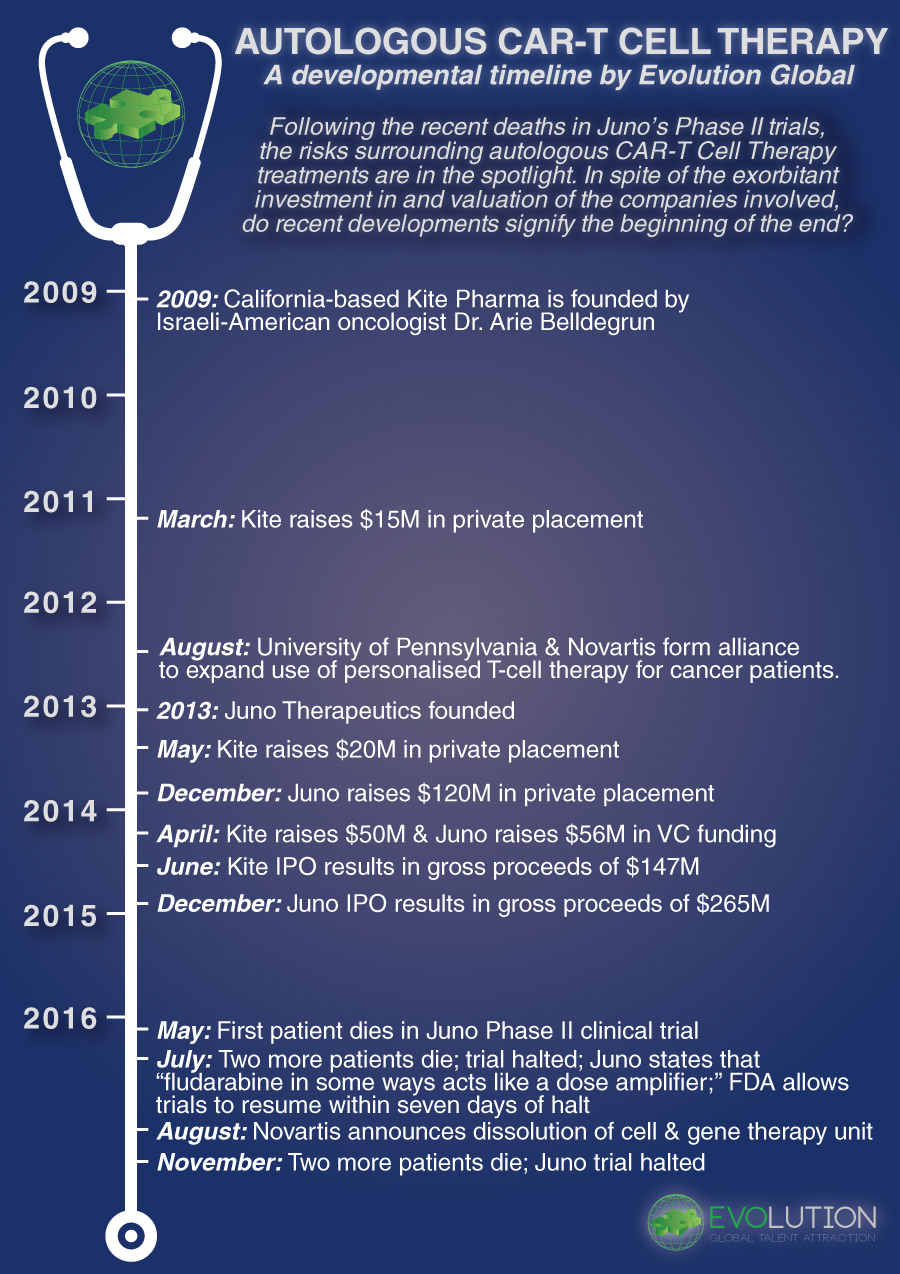

From a timeline perspective, the situation has developed as follows:

“From the early days of hype and hope the led to exorbitant investment in and valuation of newly-formed companies, Autologous CAR-T would appear to be unravelling both clinically and financially in recent months,” notes Evolution Bioscience Director Dr. Frank Rinaldi. “Additionally, there will no doubt be serious questions asked of the FDA as to why the Juno trial was resumed so quickly.”

According to Dr. Rinaldi, “It’s been known from day one that CAR-T therapy, whilst holding significant promise, is associated with adverse event issues, the management of which remains a challenge. Ultimately the field is a highly speculative endeavour that was given a gloss of high credibility by the early engagement of Novartis in 2012.”

At their high points, the MarCap of Juno and Kite were $6B+ collectively. Obviously, Juno has taken a serious hit following the patient deaths, but is still valued at $2.39B as of November 29, 2016.

All eyes are now on the outcome of Kite’s development for the treatment of advanced diffuse large B-cell lymphoma (DLBCL), as well as Novartis’s focus on relapsed or refractory non-Hodgkin lymphoma. If either fail, it will likely signal the demise of autologous CAR-T immunotherapies. Conversely, if successful, the developments may well signal the beginning of a revolutionary treatment path for those suffering from cancer, with the Juno failure likely to be viewed as one those things that happens during early stage novel treatment development.

Whatever happens, however, all Autologous CAR-T immunotherapies will more than likely see a higher level of scrutiny from the FDA following their fatal mistake with JCAR015.

You can download a PDF copy of our Autologous CAR-T Immunotherapy Timeline via the button below: