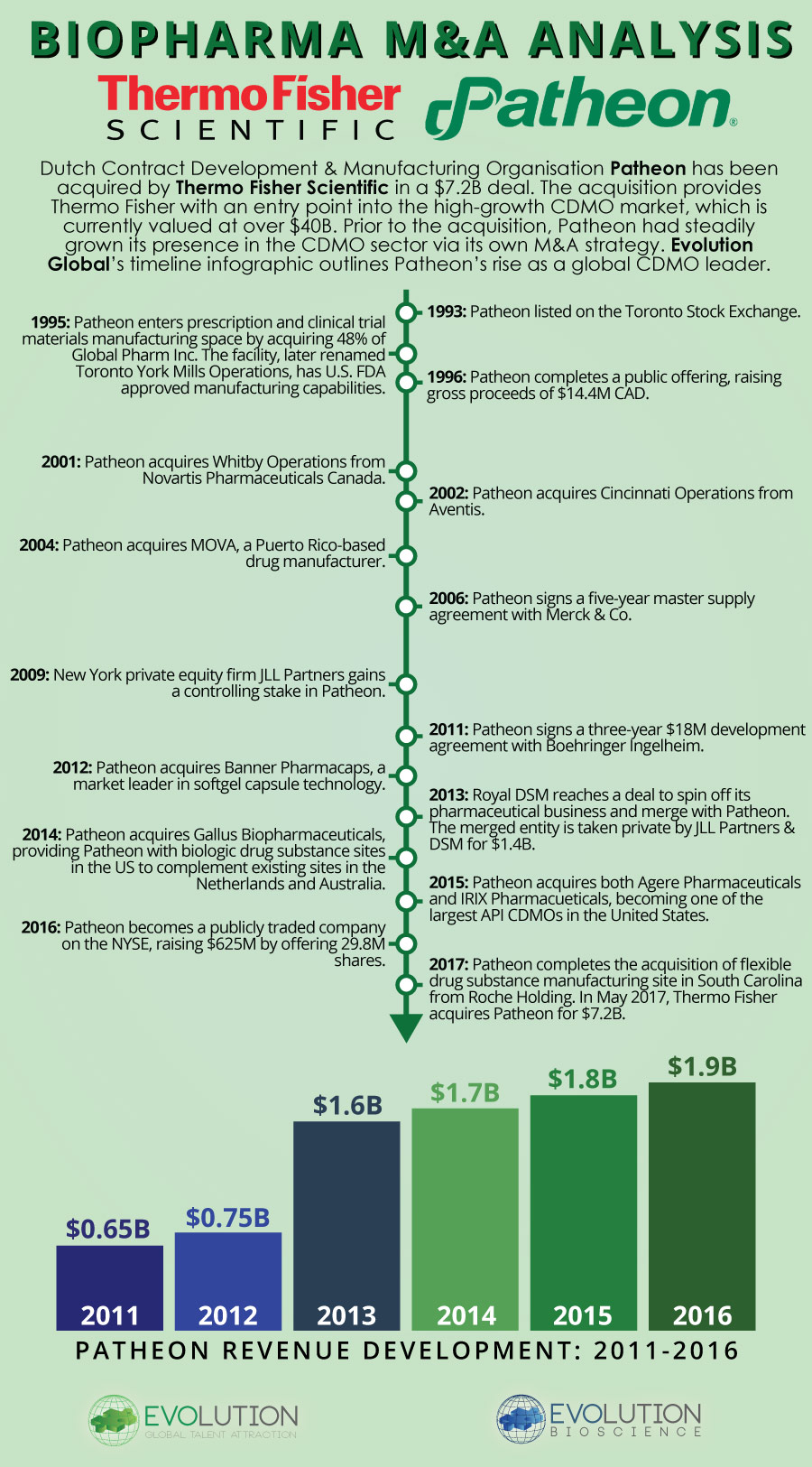

Dutch Contract Development & Manufacturing Organisation Patheon has been acquired by Thermo Fisher Scientific in a $7.2B deal. The acquisition, which includes the assumption of approximately $2B of net debt, provides Thermo Fisher with an entry point into the high-growth CDMO market, which is currently valued at over $40B.

This a key step that signals Thermo Fisher’s strategic intent to move from a leading supplier of tools for biopharma manufacture to an integrated industry leader that also offers the capability to manufacture on a contract basis. Prior to the acquisition, Patheon had steadily grown its presence in the CDMO sector via its own M&A strategy. This strategy was so successful that the company claims that all 16 NDAs approvals in 2016 involved Patheon as the key outsource partner.

Our timeline infographic below highlights Patheon’s strategic growth from the 90s through to its acquisition by Thermo Fisher. The key inflection point in Patheon’s strategic development was its merger with Royal DSM, which effectively doubled revenue in 2013.

The CDMO market is considered to be a $40B+ global outsourcing opportunity. Relative to its competition, Patheon has positioned itself as a market leader offering a greater range of services across all aspects of the market’s segments.

It’s likely that the acquisition is highly accretive for Thermo Fisher, benefiting its position within the Bioproduction and Clinical Trials business units. Thermo is now able to offer clients an increasingly vertically-integrated CDMO that can leverage synergistic cost efficiencies across several key services where it has a significant market share already.

Thermo Fisher’s Gibco™ Bioprocessing, Single-Use Bioprocessing, Chromatography and Protein Purification, and Contaminant & Impurity QC Testing brands are complementary to Patheon’s Biologics development and manufacturing capabilities. Additionally, Patheon’s Formulation and Development capabilities compliment Thermo’s Clinical Services applications (packaging, distribution & logistics), coupling clinical trials capabilities to scale manufacturing services.

It will be interesting to monitor the biopharmaceutical M&A space for moves by Thermo Fisher’s key competitors such as Lonza, Merck and GE. Of these companies, only GE has not taken the step of offering at least some aspects of CDMO manufacture.

You can download a PDF copy of our Thermo Fisher/Patheon infographics via the buttons below: