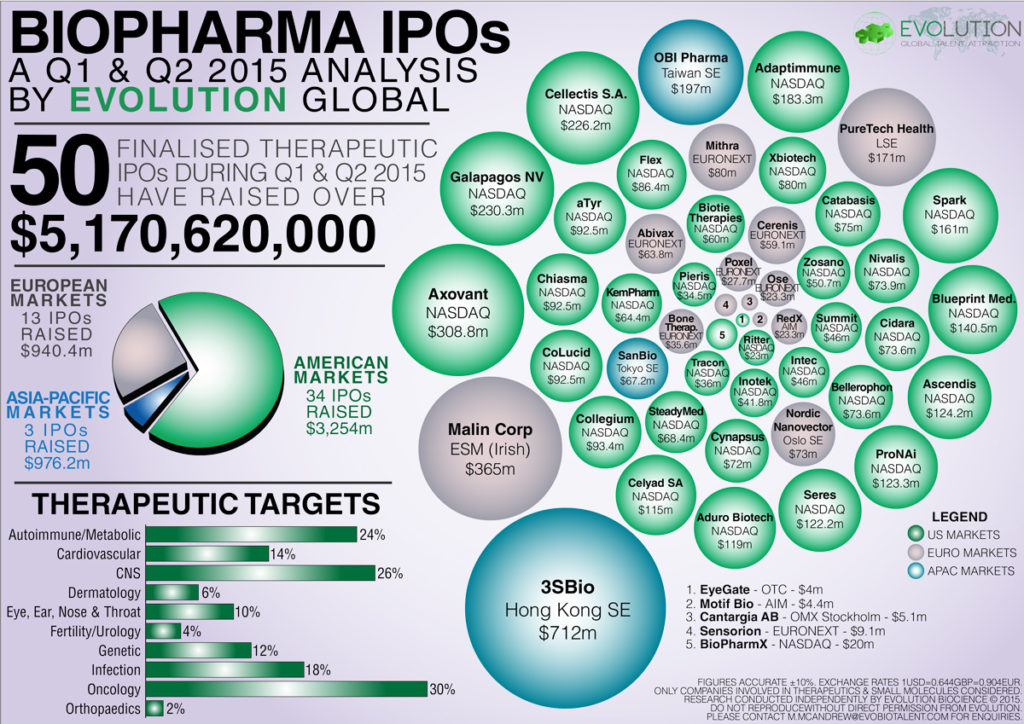

In the first half of 2015 fifty therapeutics companies finalised their IPOs, raising over $5.17 billion across multiple global exchanges. Evolution Global Talent Attraction analysed the therapeutic targets and IPO details of each of these fifty companies, and we’ve published our findings as an infographic.

Of the 50 therapeutic IPOs this year Chinese biotech company 3SBio raised the most capital, attracting $712m on the Hong Kong Stock Exchange. Irish life science investment group Malin Corp. ranked second, raising an impressive $365m on the ESM market.

Of the 34 NASDAQ IPOs, Bermuda-based Axovant raised the most funds, accumulating $308.8m for their clinical-stage Alzheimer’s research. Whilst NASDAQ was the most popular market for biopharma IPOs, 40% of the NASDAQ IPOs in 2015 were for companies based outside of the USA.

Unsurprisingly the majority of therapeutic companies are focused on oncology (30%), followed by CNS-related disorders (26%) and Autoimmune/Metabolic diseases (24%). Of the 50 companies assessed, 18 have a drug development candidate that has been designated with orphan drug status (36%).

Check out the full infographic below, or download your own PDF copy.

Follow Evolution Global Talent Attraction on Twitter, Facebook and LinkedIN to keep up-to-date with news and trends from the biotechnology, biosciences, medical device, IT and Intellectual Property industries.