Personal genomics company 23andMe recently entered a four-year $500M collaborative agreement with major pharmaceutical company GlaxoSmithKline. The deal gives GSK access to the genetic data of 23andMe’s 5 million customers, which GSK will use to identify new drug targets and develop more effective treatments. However, as genetic testing becomes more readily available to consumers, ethical concerns are being raised with regards to the privacy and ownership of genetic data. As patients begin to understand the value of their genomic and healthcare data, disruptive innovators have launched blockchain solutions that seek to democratise genomic data and alleviate privacy concerns.

Personal genomics company 23andMe recently entered a four-year $500M collaborative agreement with major pharmaceutical company GlaxoSmithKline. The deal gives GSK access to the genetic data of 23andMe’s 5 million customers, which GSK will use to identify new drug targets and develop more effective treatments. However, as genetic testing becomes more readily available to consumers, ethical concerns are being raised with regards to the privacy and ownership of genetic data. As patients begin to understand the value of their genomic and healthcare data, disruptive innovators have launched blockchain solutions that seek to democratise genomic data and alleviate privacy concerns.

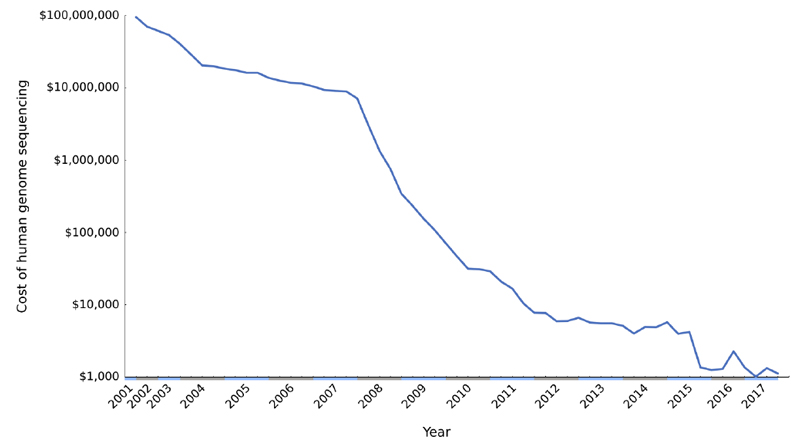

There is a growing consumer appetite for personal genetic testing, in part due to its lowering cost. The Human Genome Project first sequenced the human genome in 2003 at a cost of around $2.7 billion, but advances in technology mean that the cost of consumer testing has now dropped well below $1000 and is forecast to drop below $100 within the next few years. It is estimated that over 12 million people have now had their genetic makeup tested, with more consumers tested in 2017 than all other years combined.

Figure 1: Cost of Human Genome Sequencing Over Time

Figure 1: Cost of Human Genome Sequencing Over Time

DNA Microarray-based Genotyping vs. Whole Genome Sequencing

23andMe utilises DNA microarray-based genotyping to test saliva samples, offering insights into the individual’s genetic history and predisposition to diseases. 23andMe offers genetic testing at a relatively low cost ($129) to the consumer by subsequently selling on its customers’ genetic data to other larger companies. 23andMe’s terms and conditions clearly outline that the company has the right to sell on anonymised genomic data to third parties, with all clients consenting to this data sharing policy when sending saliva samples for personal testing. Whilst this is entirely legal, it has raised significant privacy concerns.

Research scientists require robust and consistent genomic data sets in order to identify the cause of disease and develop treatments. The DNA microarray-based genotyping utilised by current industry leaders 23andMe and Ancestry identifies letters at approximately 600,000 positions, whilst whole genome sequencing identifies approximately 6.4 billion letters, including non-coding DNA variants. Considering that the genomic data provided by 23andMe is based on the outdated process of DNA microarray-based genotyping, the current genomic data market offers research scientists a fragmented and incomplete genomic profile, thereby hindering research progress.

Several other companies are offering alternative services to 23andMe, instead using DNA sequencing to give a more detailed analysis of the genome. Dante Labs offers both Whole Exome and Whole Genome sequencing using Next Generation Sequencing (NGS) technology. Genos provides Whole Exome Sequencing using NGS technology, however it must be authorised by a physician. Helix, an Illumina spinout company, aims to act as a cloud-based storage system for genetic data, and is used by partners such as Mayo Clinic and PerkinElmer. Whole genome sequencing comes at an increased cost to the consumer, and as such the personal genomics industry is currently dominated by companies utilising DNA microarray-based genotyping.

Democratising Genomic Data with a Disruptive Blockchain Solution

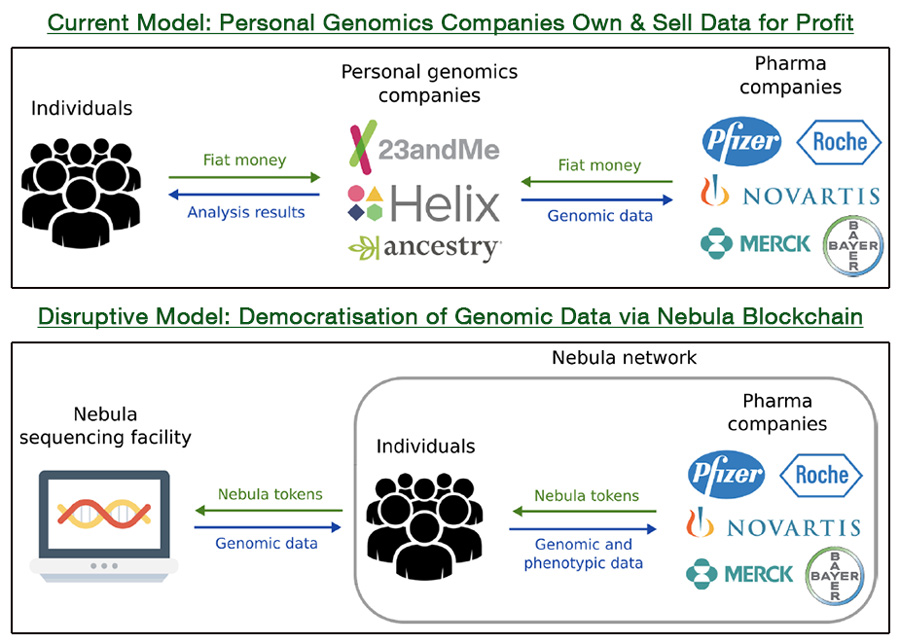

Nebula Genomics, a start-up founded by the “father of synthetic biology” George Church, aims to tackle this challenge by utilising blockchain technology to create a democratised marketplace for genomic and healthcare data that enables individuals to control what data is shared and who it is shared with. Nebula Genomics offers an alternative service whereby customers convert traditional fiat currency into Nebula tokens, which are then used to pay for whole genome sequencing. The resulting data is stored on Nebula’s secure blockchain network, and ownership of the genomic data is handed back to the consumer (data owner). Companies and researchers can then acquire bulk sets of genomic data through the Nebula blockchain network with the consent of individual data owners, with data owners being individually rewarded for sharing their data in the form of Nebula tokens. These Nebula tokens can then be converted back into a major cryptocurrency such as ether or bitcoin, which can subsequently be exchanged back into local fiat currency.

Figure 2: Traditional Business Model of Personal Genomics Companies vs. Nebula Genomics’ Disruptive Blockchain Model

Figure 2: Traditional Business Model of Personal Genomics Companies vs. Nebula Genomics’ Disruptive Blockchain Model

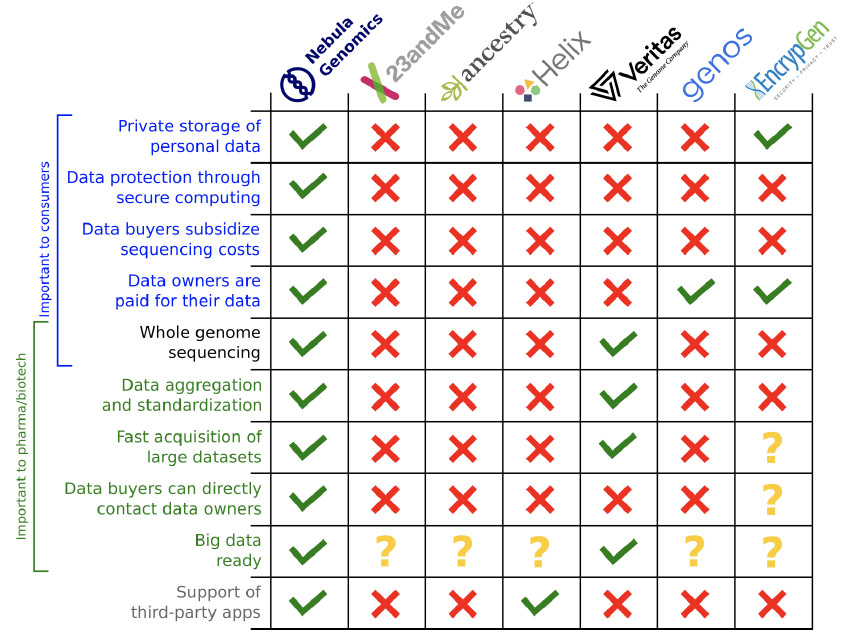

Whilst Nebula Genomics is not the first company to propose a blockchain solution for genomic and healthcare data, the strength of its management team, partners and advisors has cemented the company as an early leader in this burgeoning space. Most importantly, Nebula has partnered with Veritas Genetics to provide robust whole genome sequencing services. Additionally, the Nebula blockchain network will enable researchers and pharmaceutical companies to collect phenotypic data by sending survey questions to individual data owners. All data will be standardised, ensuring robust data sets for researchers.

Figure 3: Personal Genomic Sequencing Competitor Analysis

Figure 3: Personal Genomic Sequencing Competitor Analysis

Conclusions

With increasing demand for personal genomic testing, it is likely that consumer genomics providers such as 23andMe and Ancestry will continue to dominate the market in the short term. However, given the significant data quality and privacy concerns raised by both researchers and consumers, this is an area ripe for disruptive innovation. In this regard, it is only a matter of time before blockchain and big data revolutionise the personal genomics space. Scientific researchers and big pharma’s need for robust, standardised genomic data sets will drive progress in this space, and it remains to be seen how 23andMe will adapt to shifting expectations.

Figures 1, 2 & 3 sourced & adapted from Nebula Genomics white paper.

Follow Evolution Bioscience on LinkedIn to keep up-to-date with news and trends from the biotechnology, biopharmaceutical, medical device and related industries.